Add WeChat

-

15year

Singapore company tax audit experience

-

9year

Senior accountant's professional experience

-

16000+

Partner

-

98%

Customer cooperation rate

Singapore Tax Audit

Singapore company consequences of non tax audit

-

1

FineSingapore has strict regulations on taxation, and companies that fail to file tax declarations on time may be pursued for tax payments by the tax authorities, or even forced to pay taxes.

FineSingapore has strict regulations on taxation, and companies that fail to file tax declarations on time may be pursued for tax payments by the tax authorities, or even forced to pay taxes. -

2

AccountabilityAccording to Singaporean law, those who fail to pay or underpay a certain amount or proportion of taxes may be sentenced to imprisonment, detention, and fines.

AccountabilityAccording to Singaporean law, those who fail to pay or underpay a certain amount or proportion of taxes may be sentenced to imprisonment, detention, and fines. -

3

ReportedIf the tax declaration form is not submitted for more than two years, one may be sued in court. After being convicted, the company must repay a fine of twice the amount of taxes levied as instructed by the court.

ReportedIf the tax declaration form is not submitted for more than two years, one may be sued in court. After being convicted, the company must repay a fine of twice the amount of taxes levied as instructed by the court. -

4

Damage to reputationUnable to obtain commercial loans from legitimate channels for capital turnover; Investors may have doubts about the financial condition of a company and easily lose confidence in it.

Damage to reputationUnable to obtain commercial loans from legitimate channels for capital turnover; Investors may have doubts about the financial condition of a company and easily lose confidence in it.

If you have any doubts, feel free to consult online now to solve your core problems

Singapore Tax Audit

The following situations Singaporean companies must conduct audits

- The total sales and assets of the Singapore company and its affiliated groups are both greater than SGD 10 million

- The total sales revenue of the Singapore company and its affiliated groups is over SGD 10 million and the number of employees is over 50

- The total assets of the Singapore company and its affiliated groups are greater than SGD 10 million and the number of employees is greater than 50

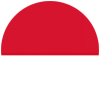

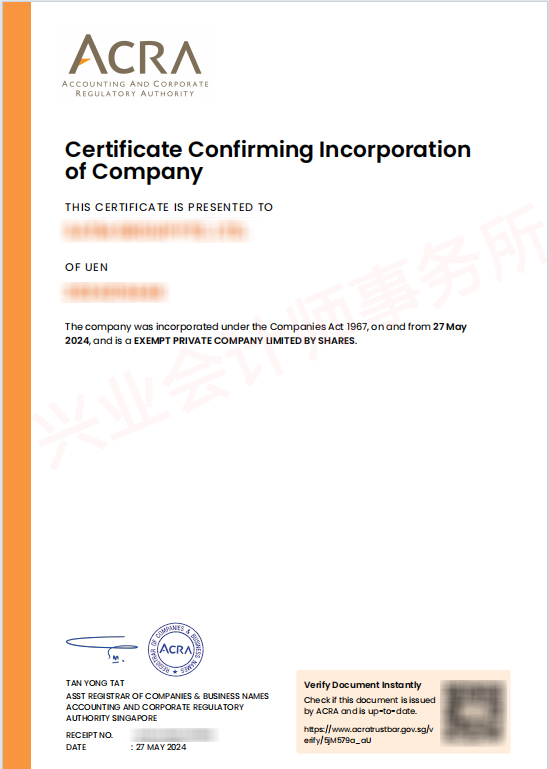

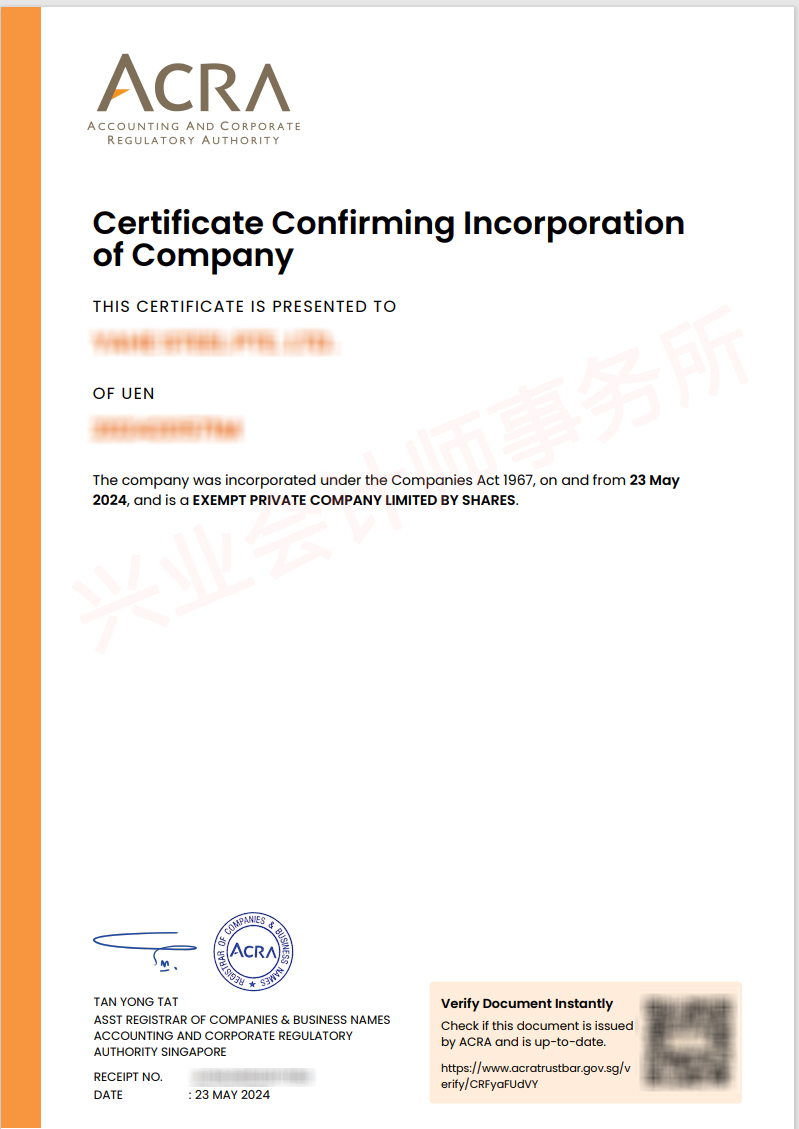

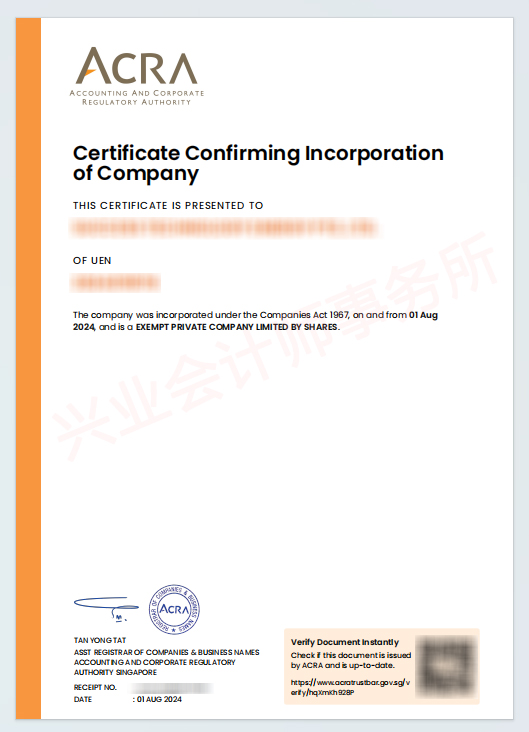

Professional and rigorous service, customers can choose us with more confidence

Since conducting business online, Xingye Accounting has provided services to over 16000 enterprises, including more than 200 TOP enterprises The customer cooperation signing rate is 98%, and the cooperation customer renewal rate is 90% Real customer cases are recorded throughout the entire process, and professional abilities can withstand the test

Singapore based accounting firm without intermediaries

Direct sales between China and Singapore The Singapore company team can receive you for inspection and assist in handling matters Each branch team of the domestic group can provide on-site service

-

Familiar with the tax policies and business environment of various Southeast Asian countries, including Singapore, proficient in international tax agreements, and able to provide very professional solutions for enterprises to invest overseas.

-

We treat all customers with sincerity, and domestic and Singaporean companies can provide one-on-one services to customers, achieving quick response and reducing customer worries.

-

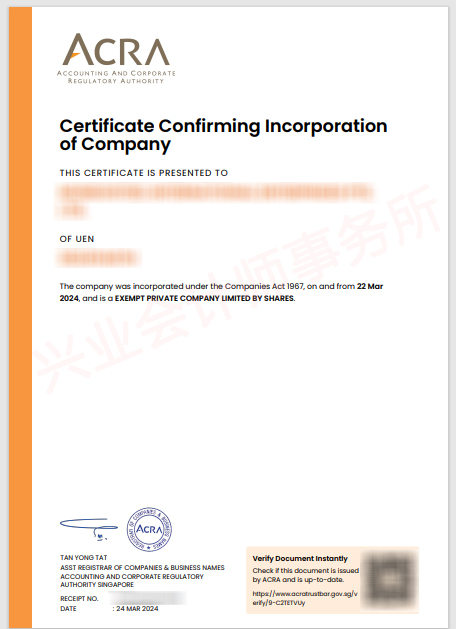

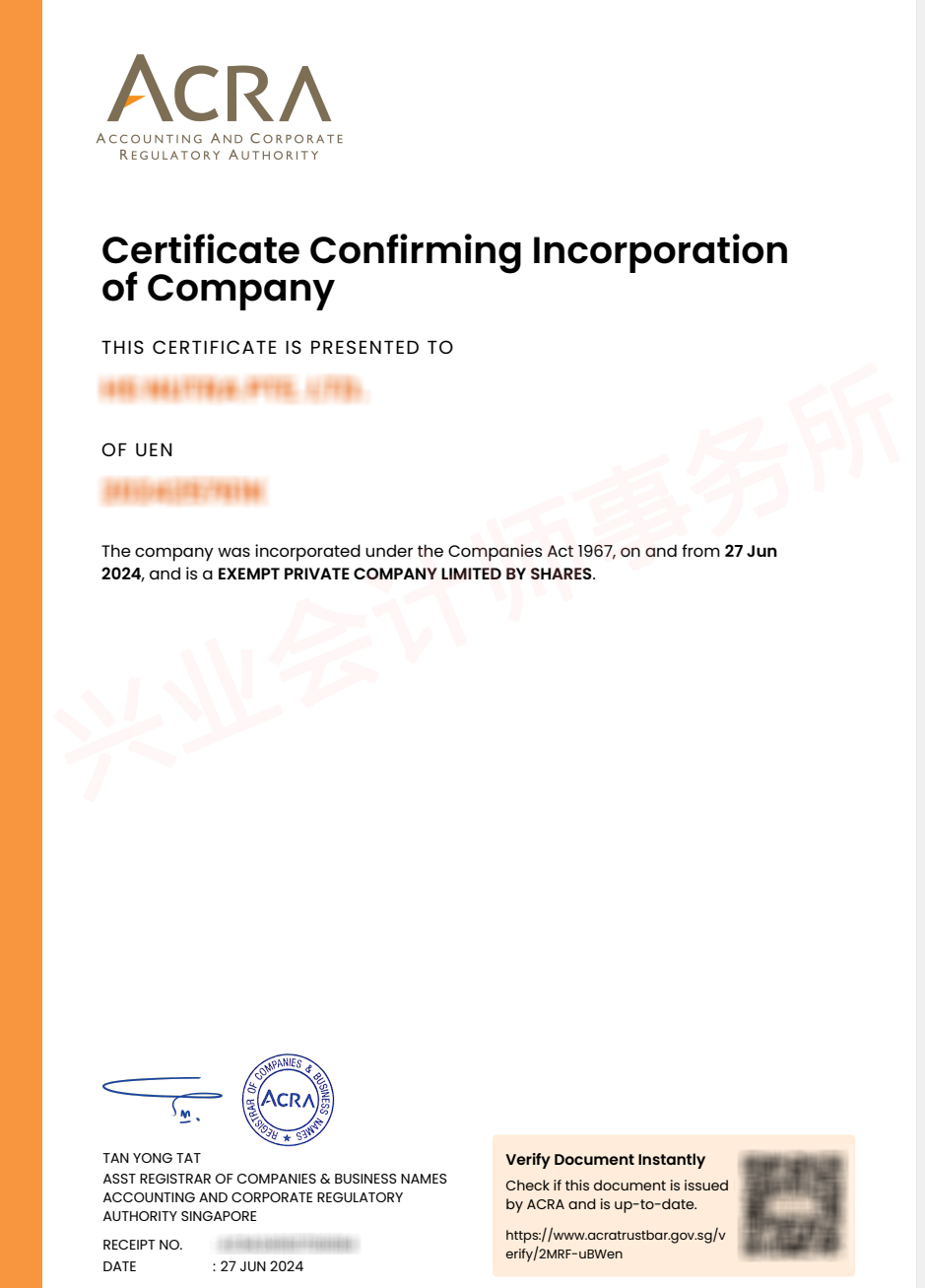

We hold Singapore ACRA Secretary License and Singapore Human Resources License, which can help businesses and clients seamlessly match Singapore immigration, children's education, and life.

-

All services are priced clearly, with real-time feedback on processing progress. If unsuccessful, all fees will be refunded without any disputes, providing customers with peace of mind.

Singapore Tax Audit

Singapore company bookkeeping and tax reporting process

-

Pre consultation and contract signing

-

You provide valid information, and our accountant will handle the accounting and issue financial statements

-

Shareholders sign the report, accountants sign the audit report

-

Submit tax returns to the Singapore government

-

Tax declaration completed, associated documents returned to customer

Honor comes from strength, trust comes from professionalism

For the past 15 years, we have been committed to providing reliable overseas investment consulting services to our clients, offering more professional solutions in overseas investment, tax planning, and identity planning, and providing high-value services higher than those in the same industry

Professionalism leads to specialization, and professionals solve problems more thoroughly!

WeChat QR code