1. Hong Kong company name: Chinese is optional, English is required. The Chinese name should end with "Limited Company", and the English name should end with "Limited". The name must undergo name verification by the Hong Kong Companies Registry and cannot be the same as a registered company; 2. Hong Kong company shareholders and directors: Hong Kong companies require at least one shareholder and one director, and they can be the same person. Shareholders and directors must be at least 18 years old and can be natural or legal persons, with no nationality restrictions; 3. Company Secretary: Hong Kong companies must appoint a statutory secretary, who can be a Hong Kong resident or a limited company established in Hong Kong, responsible for handling communication between the company and government departments, ensuring compliance with Hong Kong laws and regulations; 4. Hong Kong company registered address: Hong Kong companies must provide a valid address located locally in Hong Kong, which can be the actual office address or provided by a professional secretarial agency (such as our company, Xingye Certified Public Accountants); 5. Registered capital of a Hong Kong company: The standard registered capital of a Hong Kong company is HKD 10000, which does not require actual payment. There is no upper limit to registered capital, but excessive registered capital may result in higher stamp duty when converted into shares in the future.

Before registering a HK company, check if the company name can be registered

Hong Kong Registered company

HK registered company advantages

HK has established a comprehensive tax collection and management system, allowing businesses operating in HK to enjoy lower tax costs

-

01

Low tax rate

The corporate income tax rate is 16.5%, and for small and medium-sized enterprises, the first 2 million Hong Kong dollars of profits enjoy a preferential tax rate of 8.25%

-

02

Simplified Tax System

The tax system structure is clear and transparent, with the main tax categories including salaries tax, profits tax, and property tax

-

03

Regional tax system

Only tax income originating from Hong Kong, tax-free for overseas income

-

04

Double Tax Treaty

Enterprises can avoid the problem of double taxation encountered in cross-border operations

-

05

No value-added tax and consumption tax

The vast majority of goods do not require customs duties, nor do they have value-added tax or consumption tax

Hong Kong Registered company

Registering a company in Hong Kong Requirements

Information

1. When the shareholder is a natural person, provide the shareholder's ID card, passport, and a photo of the upper body holding the passport. When the shareholder is a company, provide the company's registration certificate/business license; 2. Directors must be natural persons, over 18 years old, and have no criminal record. They must provide their ID card, passport, and take a photo of their upper body holding their passport; 3. Determine the business scope and equity distribution ratio.

Shareholder Director

Shareholders and directors must be natural persons, over 18 years old, and have no criminal record.

Hong Kong Registered company

Resolve the registration issues of the 6 major Hong Kong companies for you

Proficient in Hong Kong tax policies and international taxation, able to solve problems more thoroughly

-

- >What are the requirements for registering a company in Hong Kong >Requirements for registering a company in Hong Kong

Online -

- >What are the requirements for opening a bank account for a Hong Kong company >How to open an account for a Hong Kong company

Online -

- >Can registered capital of a Hong Kong company not be paid in >What is the appropriate capital for registering a company in Hong Kong

Online -

- >Detailed process for registering a new company in Hong Kong >Process and fee standards for registering a company in Hong Kong

Online -

- >List of Materials Required for Registering a Company in Hong Kong >What documents and materials are required for registering a company in Hong Kong

Online -

- >How to establish an equity structure for registering a company in Hong Kong? >How do Hong Kong companies control domestic companies?

Online

Hong Kong Registered company

Professional and rigorous service, customers can choose us with more confidence

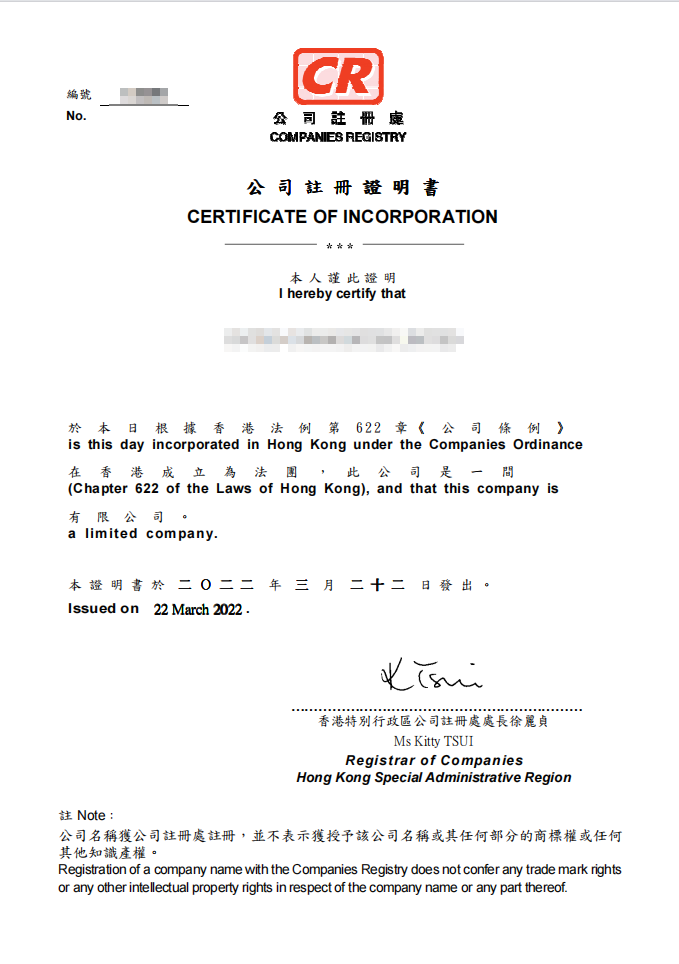

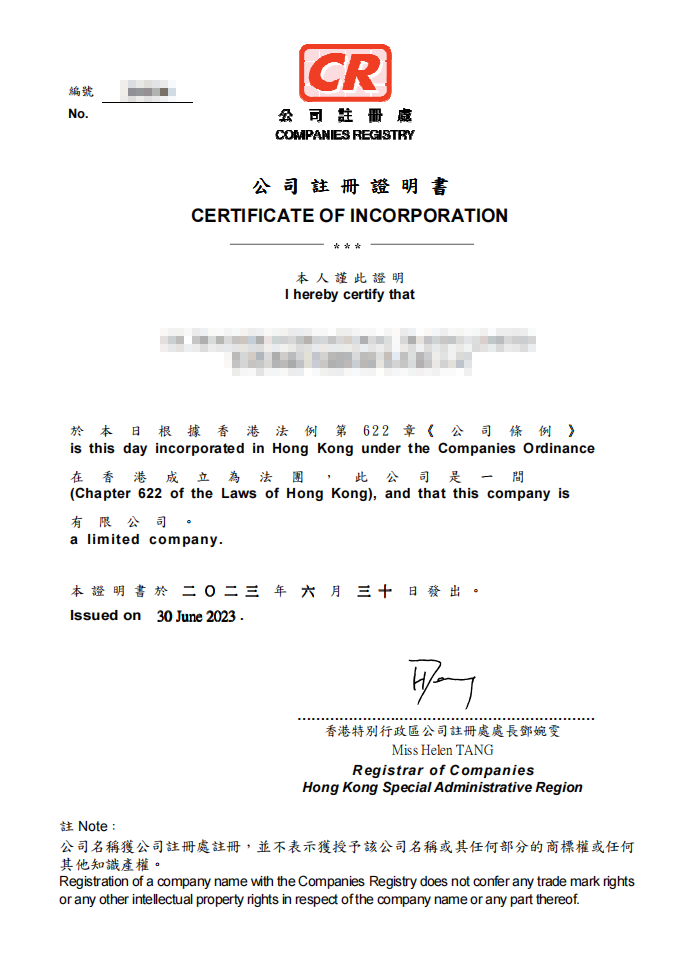

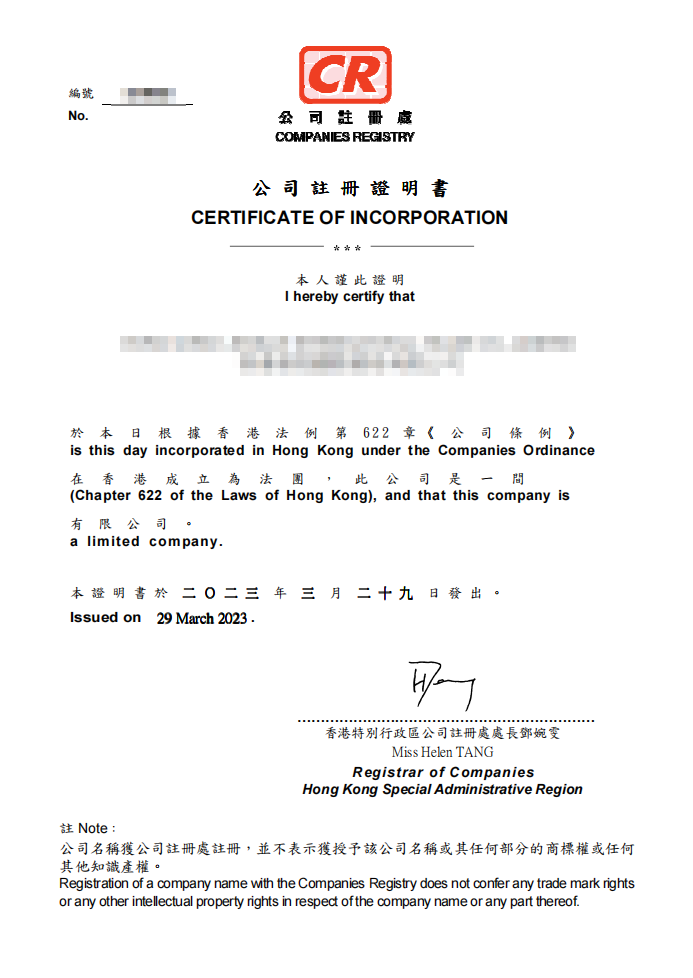

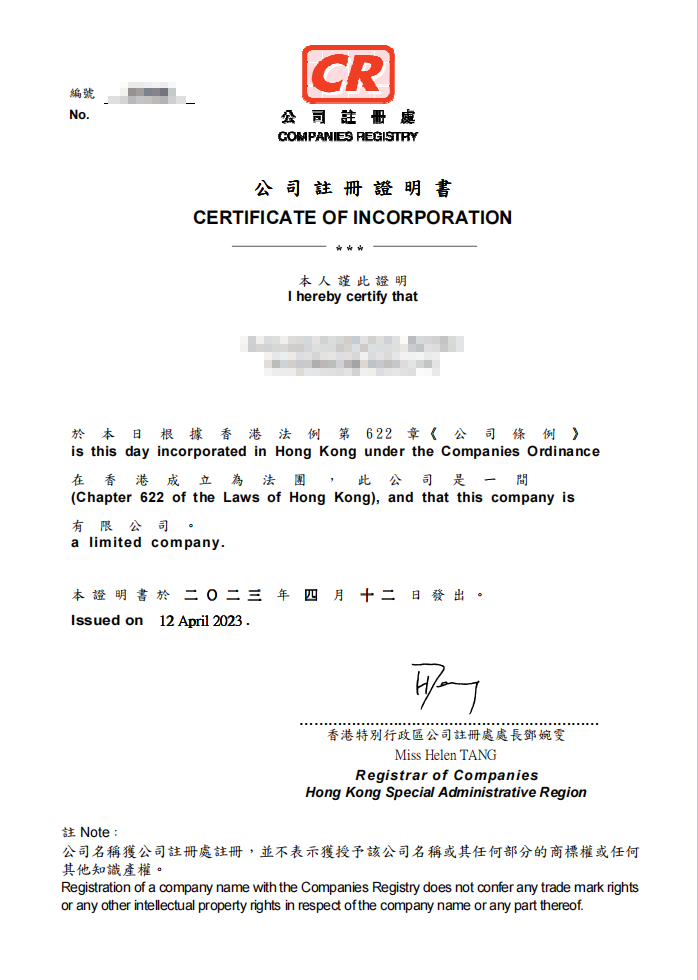

The customer cooperation rate is 98%, and real customer cases are recorded throughout the process. A large number of cases are available for inquiry, and the professional ability can withstand the test

Hong Kong Registered company

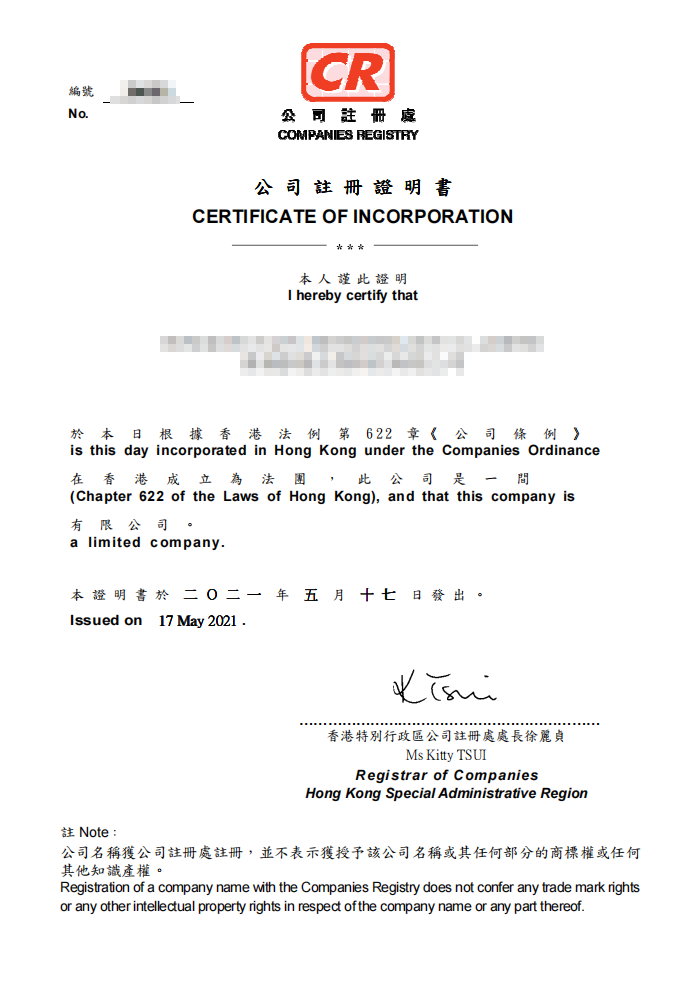

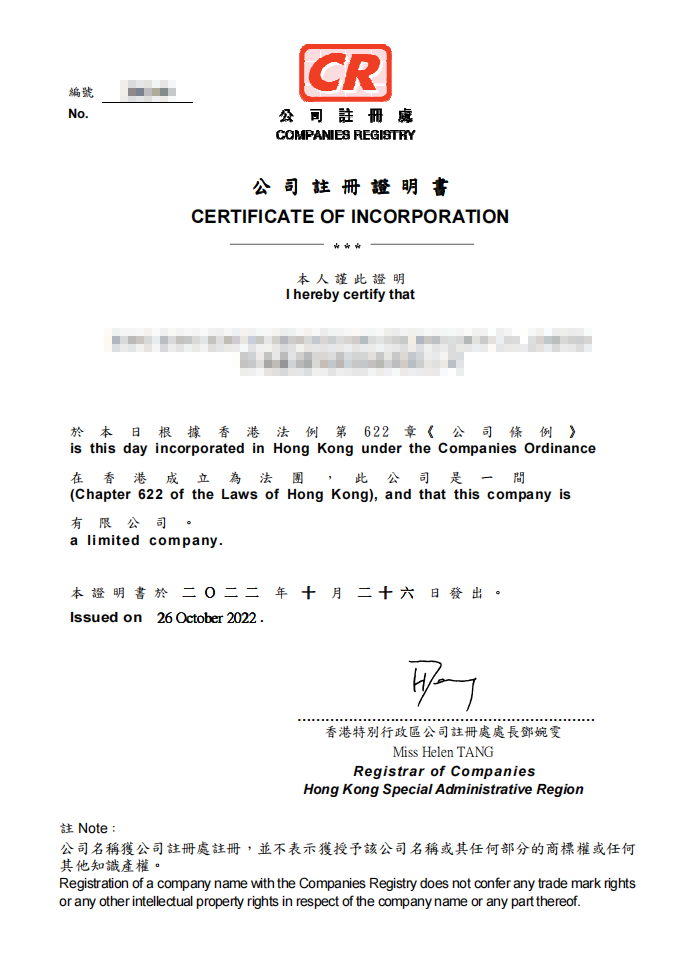

Registering a company in Hong Kong process

-

Free name verification

-

Negotiate cooperation and sign agreements

-

Organize materials and pay fees

-

Submit registration and apply for notarization

-

Registration completed

-

Mail back the registration paper

Hong Kong Registered company

Xingye Overseas provides comprehensive services for your Hong Kong company

-

Open bank account

We promise 100% successful account opening and provide multiple account opening solutions. Our bank account opening team will help you open an account.Online -

company accounting agency

Only do real accounting and continuously ensure the normal operation of your Japanese company.Online -

company annual tax review

Senior accountants are at your service, efficiently handling your Japanese company's annual tax reporting.Online -

Information change

Change of legal person, company shareholders, company name, address, and business scope modification services.Online -

Secretary Services

A legitimate licensed secretary company in Hong Kong and a whitelist of major banks in Hong Kong.Online -

Trademark registration

We provide professional, fast, and efficient trademark registration services for all overseas companies, including Hong Kong.Online -

Hong Kong Notarization and Certification

We provide professional, fast, and efficient notarization and certification services for all overseas companies, including Hong Kong.Online

Hong Kong Registered company

Hong Kong registered company looking for Xingye to go global

- Low price attraction, with one set of follow-up service fees

- The overseas company name has been rejected multiple times and has been confirmed repeatedly

- Not familiar with Hong Kong tax policies, application materials always make mistakes

- The processing flow is complex, the progress is slow, and it wastes time and energy

- Faced with unprofessional business scope, tax structure, and international taxation

- No hidden charges, transparent service

- Name verification before registering an overseas company to save time

- Senior international financial and tax accountant team, providing you with security solutions

- Our dedicated accounting team provides you with efficient service and fast processing

- Our team has an average of 9+years of experience, providing you with professional answers

Professionalism leads to specialization, and professionals solve problems more thoroughly!

WeChat QR code

Hong Kong Registered company

Registering a Company in Hong Kong Q&A