ODI, also known as Overseas Direct Investment, is an important policy introduced by the government to effectively regulate enterprises' overseas investments. This policy requires that when enterprises invest in overseas companies, whether it is establishing new companies, building new projects, or acquiring equity, as long as it involves directly or indirectly obtaining ownership of the overseas company, such as control, management, etc., they must file for ODI investment. ODI is a legal and compliant way for companies to invest overseas, and only by processing ODI can the company's funds be transferred overseas.

Which enterprises need to apply for ODI investment filing

-

There are actual projects being carried out overseas

There are actual projects being carried out overseas -

Want to repatriate overseas funds back to China

Want to repatriate overseas funds back to China -

Need to open a bank account locally

Need to open a bank account locally -

Need to open an NRA account

Need to open an NRA account -

Want to list overseas and build VIE

Want to list overseas and build VIE

One stop ODI Overseas Investment Filing Service Manager

We can provide professional landing solutions for enterprises to invest overseas, including ODI overseas investment filing and tax structure construction

-

Newly established ODI filingThe act of acquiring ownership, control, management, and equity of non-financial enterprises overseas through new establishment, mergers and acquisitions, or other means.

Newly established ODI filingThe act of acquiring ownership, control, management, and equity of non-financial enterprises overseas through new establishment, mergers and acquisitions, or other means. -

Registration of purchase type ODIThe act of acquiring non-financial enterprises overseas or obtaining ownership, control, management, and equity of existing non-financial enterprises through mergers and acquisitions (including equity mergers and acquisitions, asset mergers and acquisitions).

Registration of purchase type ODIThe act of acquiring non-financial enterprises overseas or obtaining ownership, control, management, and equity of existing non-financial enterprises through mergers and acquisitions (including equity mergers and acquisitions, asset mergers and acquisitions). -

Filing of capital increase ODIBy increasing registered capital and expanding investment scale to non-financial enterprises overseas, investment behavior in overseas enterprises can be achieved.

Filing of capital increase ODIBy increasing registered capital and expanding investment scale to non-financial enterprises overseas, investment behavior in overseas enterprises can be achieved. -

Change type ODI filingThe act of adjusting or modifying completed overseas investment projects during the process of overseas investment.

Change type ODI filingThe act of adjusting or modifying completed overseas investment projects during the process of overseas investment.

Resolve 6 major ODI Overseas Investment Filing Issues for you

-

- >What are the conditions for filing ODI foreign investment? >Conditions and precautions to be met for filing ODI foreign investment

Online -

- >What are the procedures required for ODI foreign investment filing >Which department is responsible for filing ODI overseas investment

Online -

- >What are the materials required for ODI overseas investment filing? >What documents are required for foreign investment filing

Online -

- >What are the restrictions on investment amount for ODI foreign investment filing? >How to apply for ODI foreign investment filing without being subject to foreign exchange restrictions?

Online -

- >Do I need to open a capital account for ODI foreign investment filing >What is the proof of funding source for ODI foreign investment filing?

Online -

- >Reasons for Failure to Pass Overseas Investment Filing (ODI) >Under what circumstances should enterprises register their ODI for overseas investment in fishing?

Online

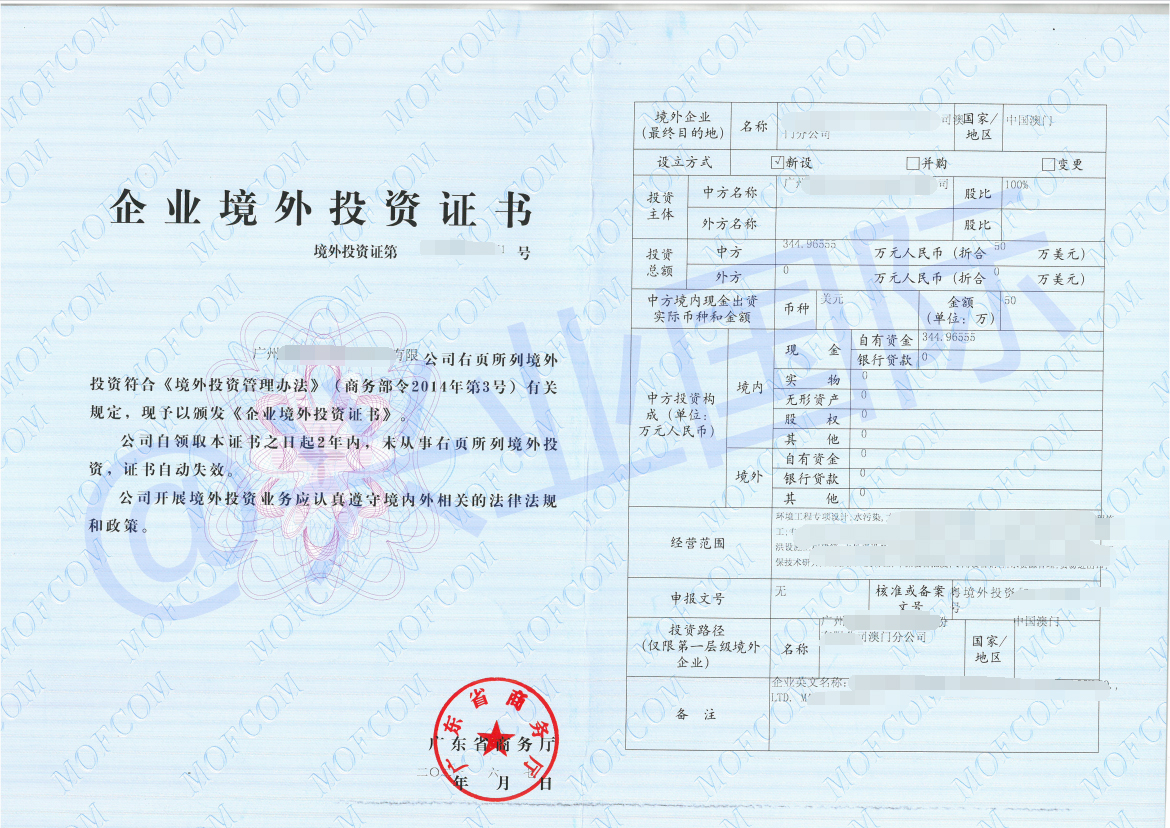

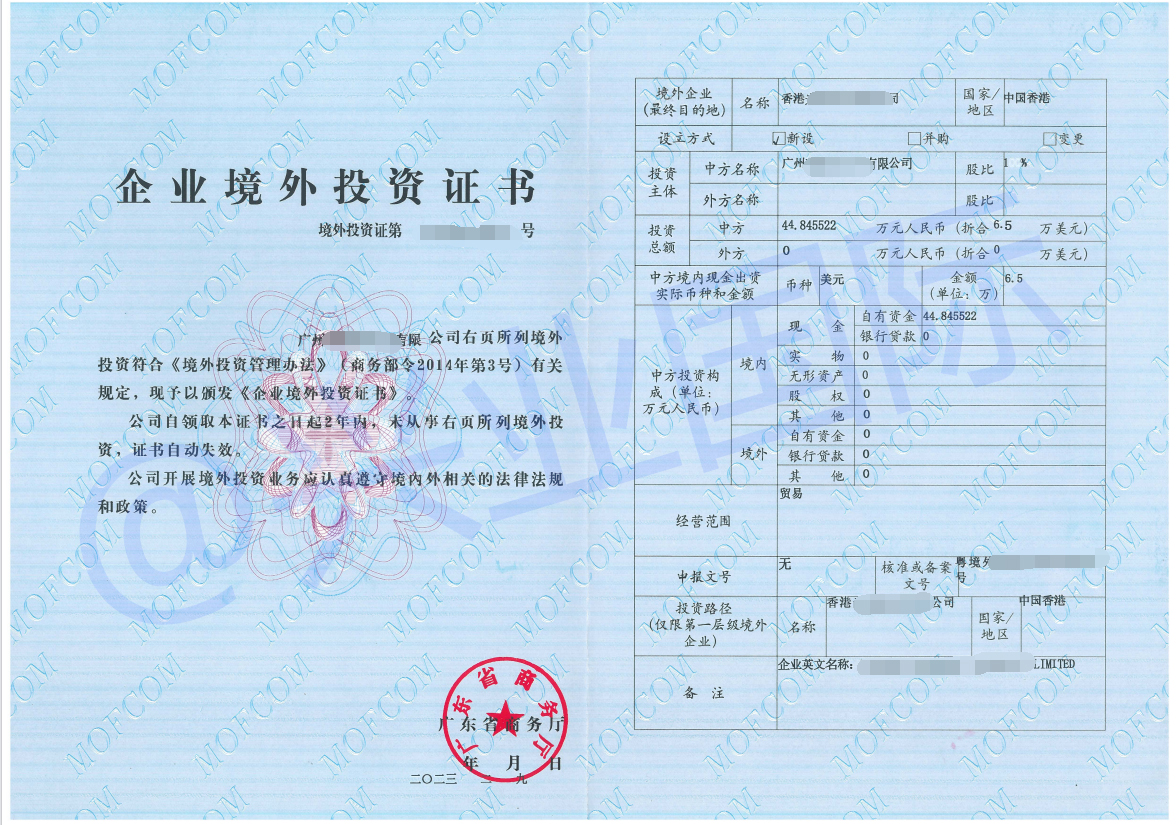

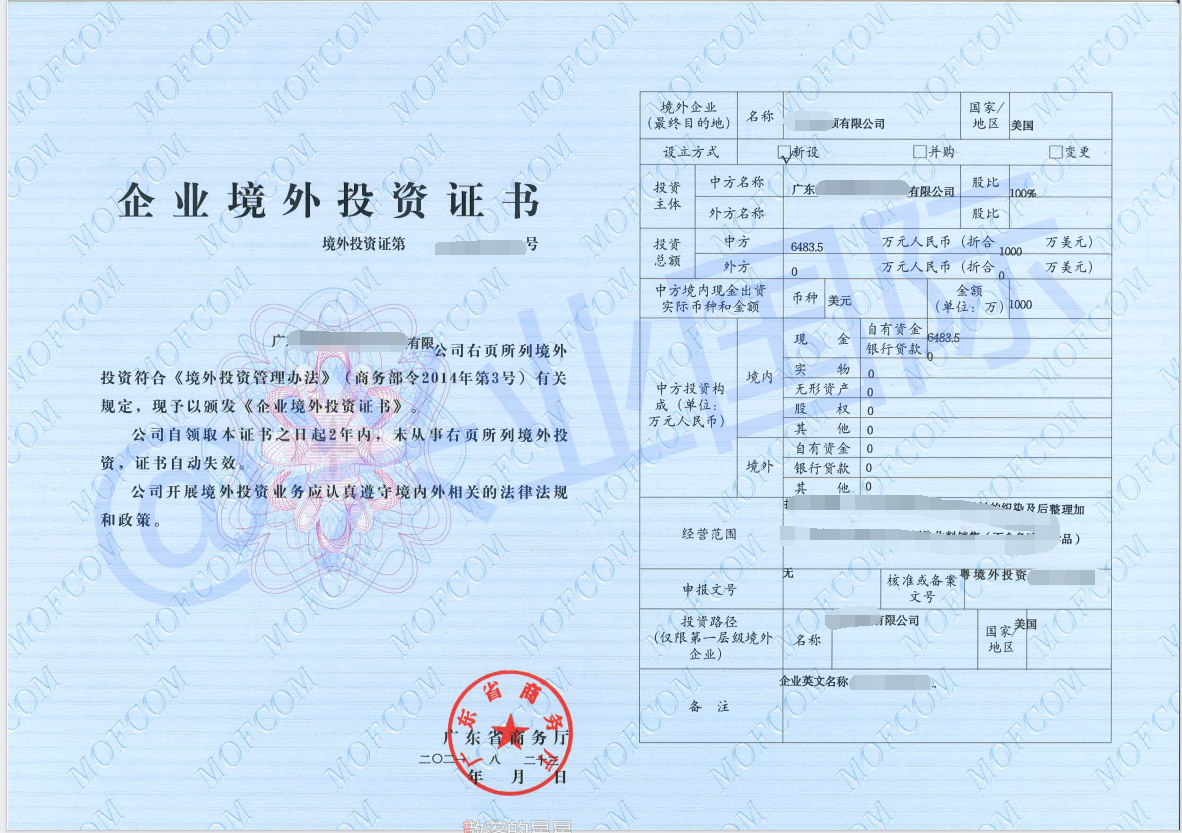

ODI Overseas Investment Filing Customer Case

Professional and rigorous service, customers can choose us with more confidence

Overseas Direct Investment

ODI Overseas Investment Filing Process

-

Consultation and Contract Signing

-

Prepare approval materials

-

Writing a professional report

-

Submit for approval

-

Regularly report progress

-

Obtain certificate and complete ODI filing

Overseas Direct Investment

ODI Overseas Investment Filing Project Advantages

-

Capital outflowThrough ODI enterprises, funds can be directly transferred overseas for forms of direct investment such as establishing subsidiaries, joint ventures, or acquiring other enterprises.

Capital outflowThrough ODI enterprises, funds can be directly transferred overseas for forms of direct investment such as establishing subsidiaries, joint ventures, or acquiring other enterprises. -

Expand a marketEnterprises can enter new markets, expand their business scope, obtain local preferential policies, and achieve global operations.

Expand a marketEnterprises can enter new markets, expand their business scope, obtain local preferential policies, and achieve global operations. -

Reduce riskInvesting in multiple countries or regions through ODI can diversify business risks and avoid trade barriers.

Reduce riskInvesting in multiple countries or regions through ODI can diversify business risks and avoid trade barriers. -

Resource integrationSome resources are in short supply or face fierce competition domestically, and overseas investment can better meet the needs of enterprises.

Resource integrationSome resources are in short supply or face fierce competition domestically, and overseas investment can better meet the needs of enterprises. -

Cost advantageOverseas labor costs, land costs, tax policies, etc. are relatively low, and ODI can reduce business operating costs.

Cost advantageOverseas labor costs, land costs, tax policies, etc. are relatively low, and ODI can reduce business operating costs. -

BrandingBy investing and operating in overseas markets, enterprises can better promote their brand awareness and image, and enhance their competitiveness in the international market.

BrandingBy investing and operating in overseas markets, enterprises can better promote their brand awareness and image, and enhance their competitiveness in the international market.

Professionalism leads to specialization, and professionals solve problems more thoroughly!

WeChat QR code

Service advantages

Advantages of Xingye's overseas service

-

15 years of industry service experience

Proficient in tax policies of various Southeast Asian countries including Singapore, Vietnam, Indonesia, Thailand, and Malaysia, and familiar with international economic law. -

Top Senior Consultant Team

We have a strong team of senior accountants, lawyers, and bank account opening professionals in the industry, with an average of over 10 years of experience, who can provide professional advice and guidance on difficult issues for your company. -

Over 30000 service companies

Thoroughly solving problems in the industry, with dozens of Fortune 500 enterprise partners and over 30000 service companies, a large number of real cases are available for you to review. Good reputation comes from our professional ability and attentive service. -

No hidden charges

We promise to have no hidden charges, never make false promises, be loyal to every commission, provide real-time feedback on processing progress, and if the processing is unsuccessful, we will unconditionally refund the full amount without any disputes.

ODI Overseas Investment Filing Q&A