Add WeChat

-

159763

Free name verification frequency

-

200

Accumulatively serving top enterprises

-

98%

Collaboration rate

Free query on whether overseas company names are registered

Introduction to Professional Services

Our services

-

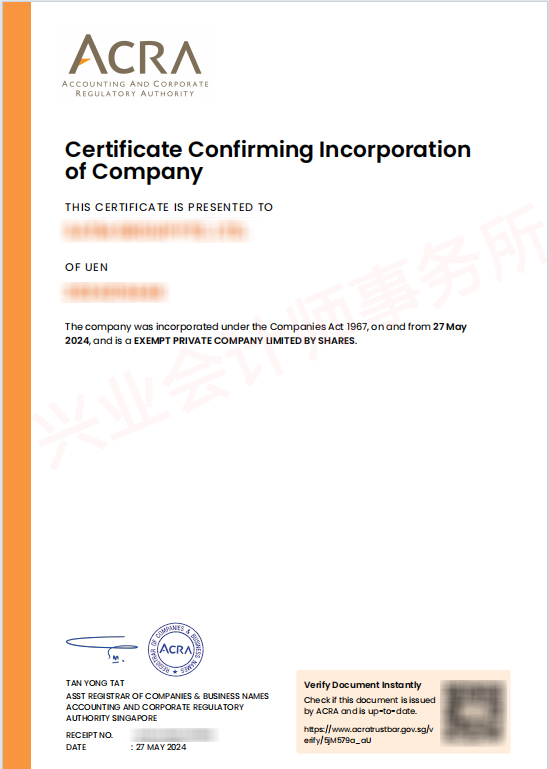

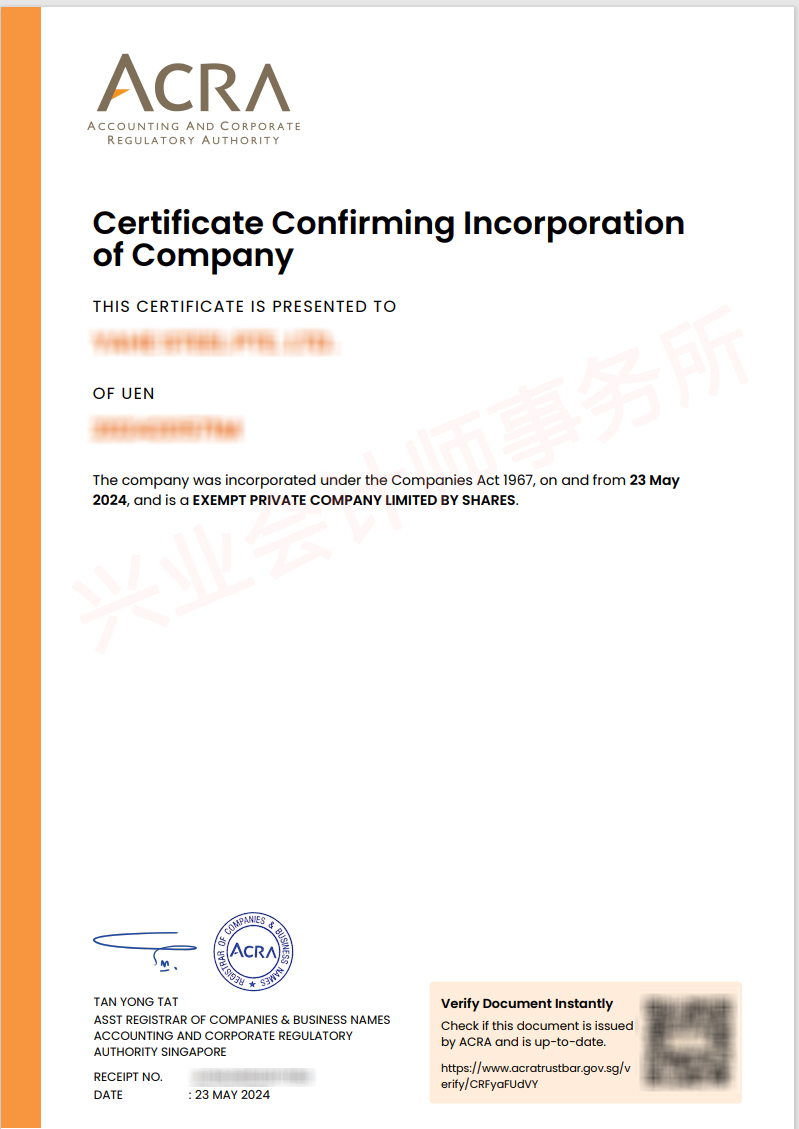

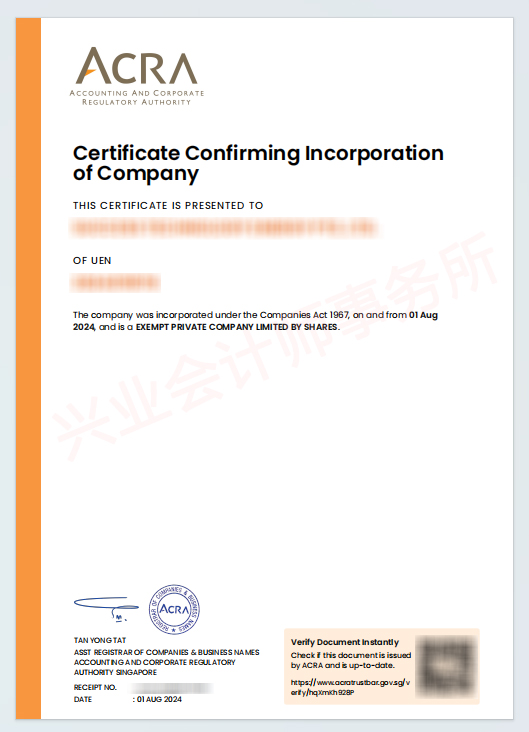

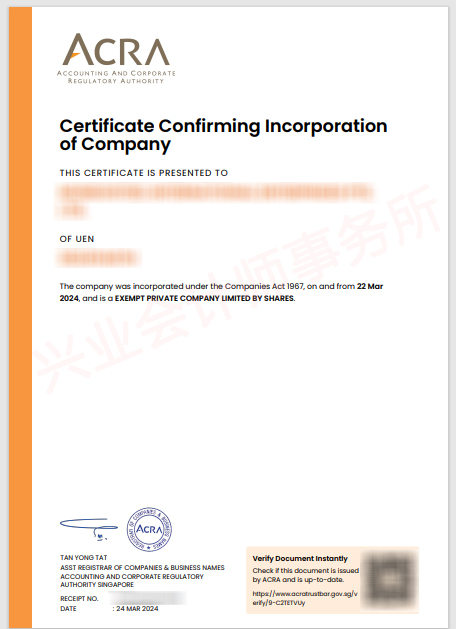

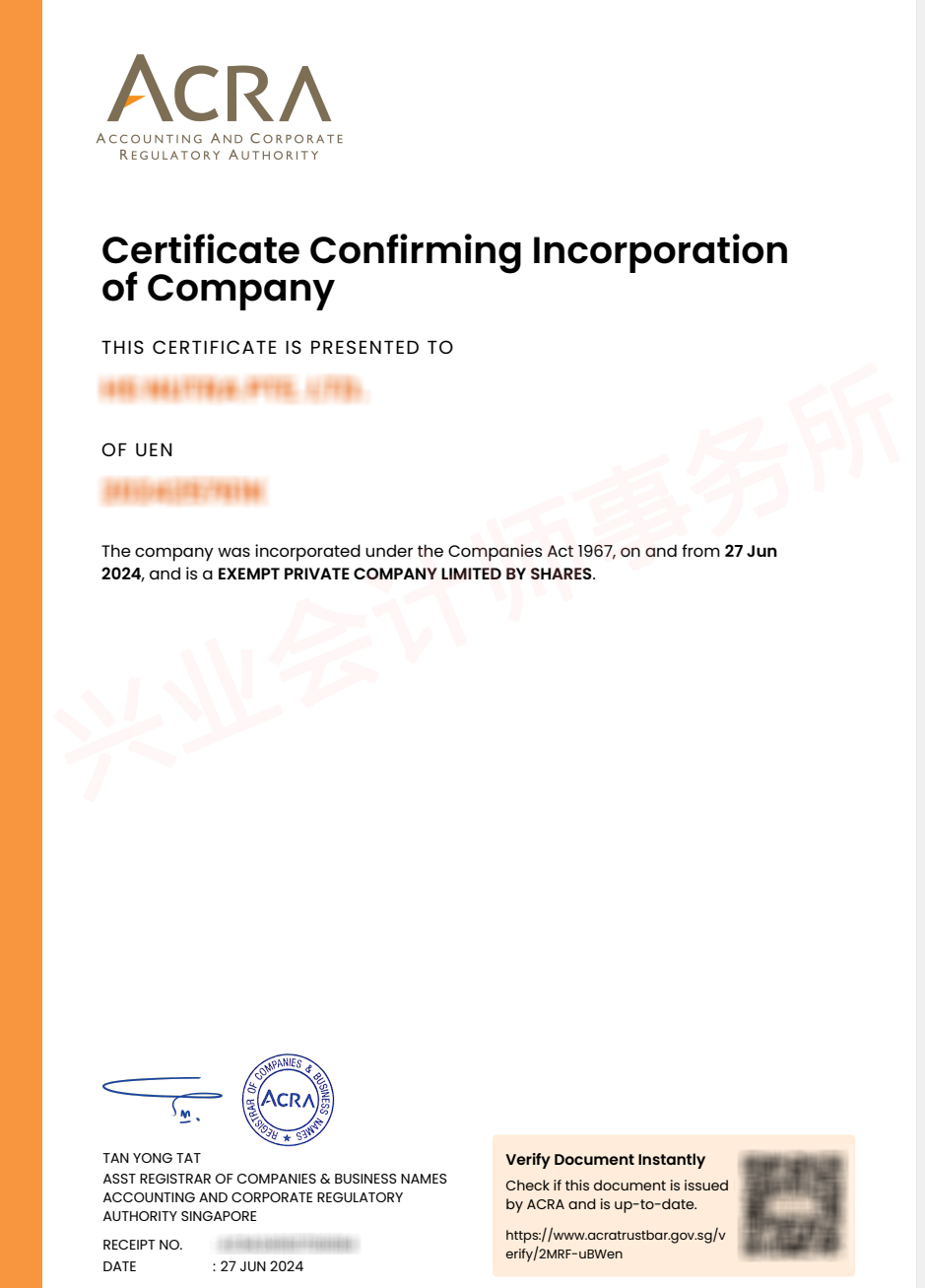

Singapore company registration

Important international financial center, international trade hub, low tax revenue Learn more> -

Vietnam company registration

A popular investment destination for Chinese enterprises, with rapid economic growth and good tax policies Learn more>

-

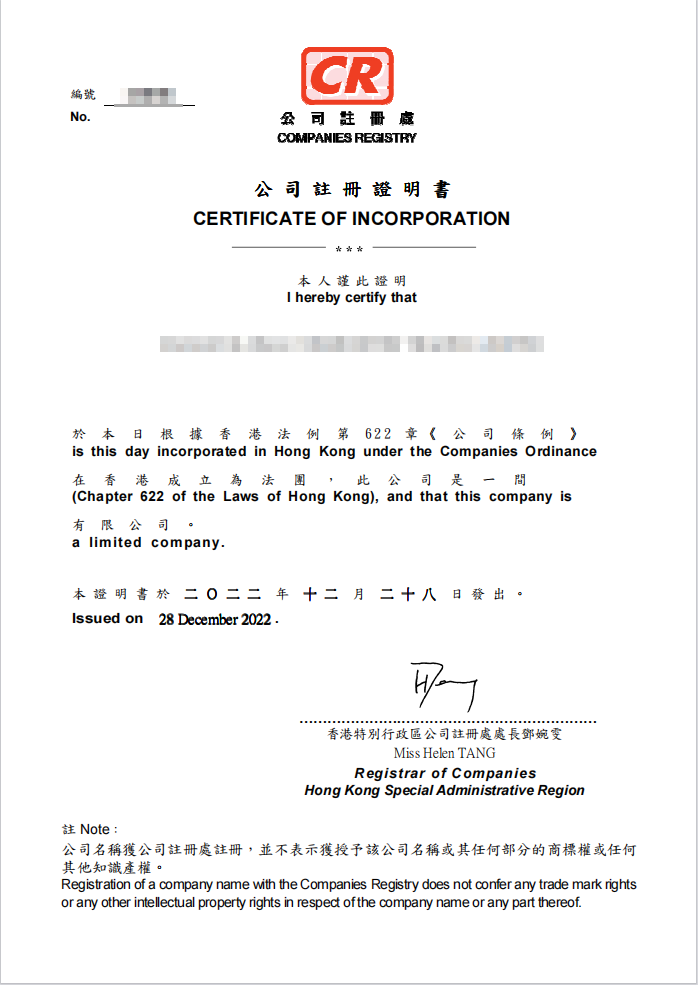

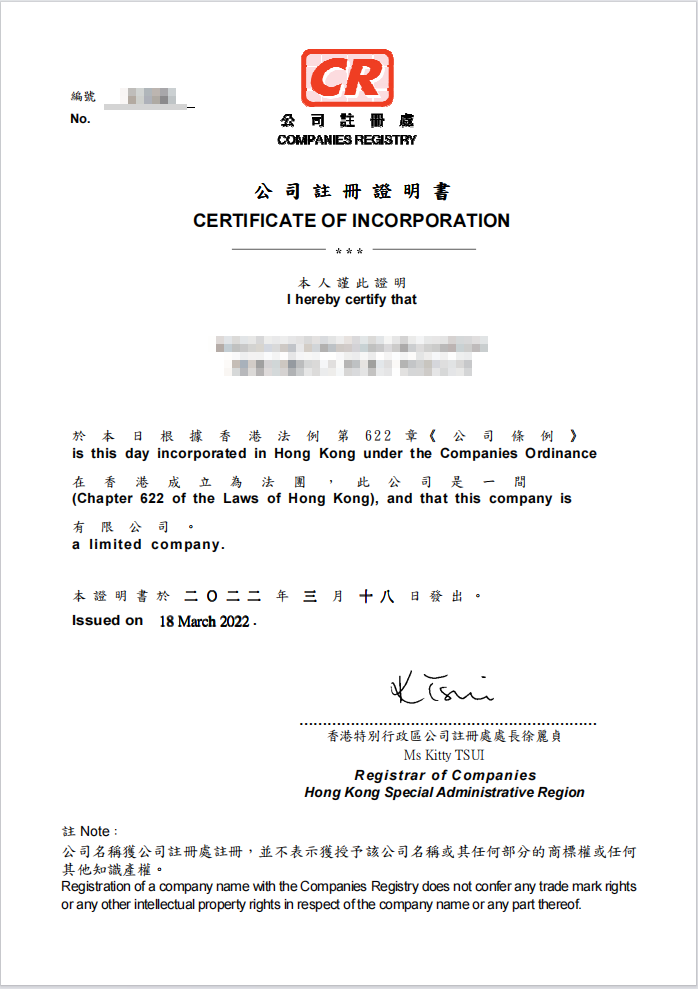

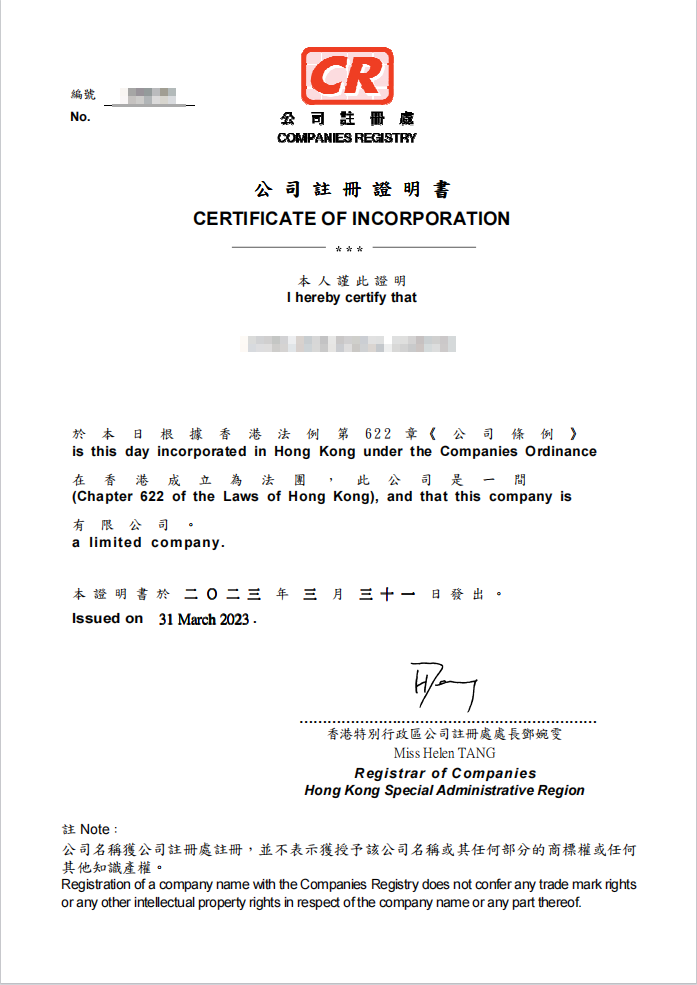

Hong Kong company registration

Important international trade hub with simple taxation and low tax rates Learn more> -

Malaysia company registration

One of the ASEAN member countries, with world-class maritime transportation and radiation Learn more> -

BVI company registration

Tax friendly policies, renowned offshore financial centers, including Learn more>

-

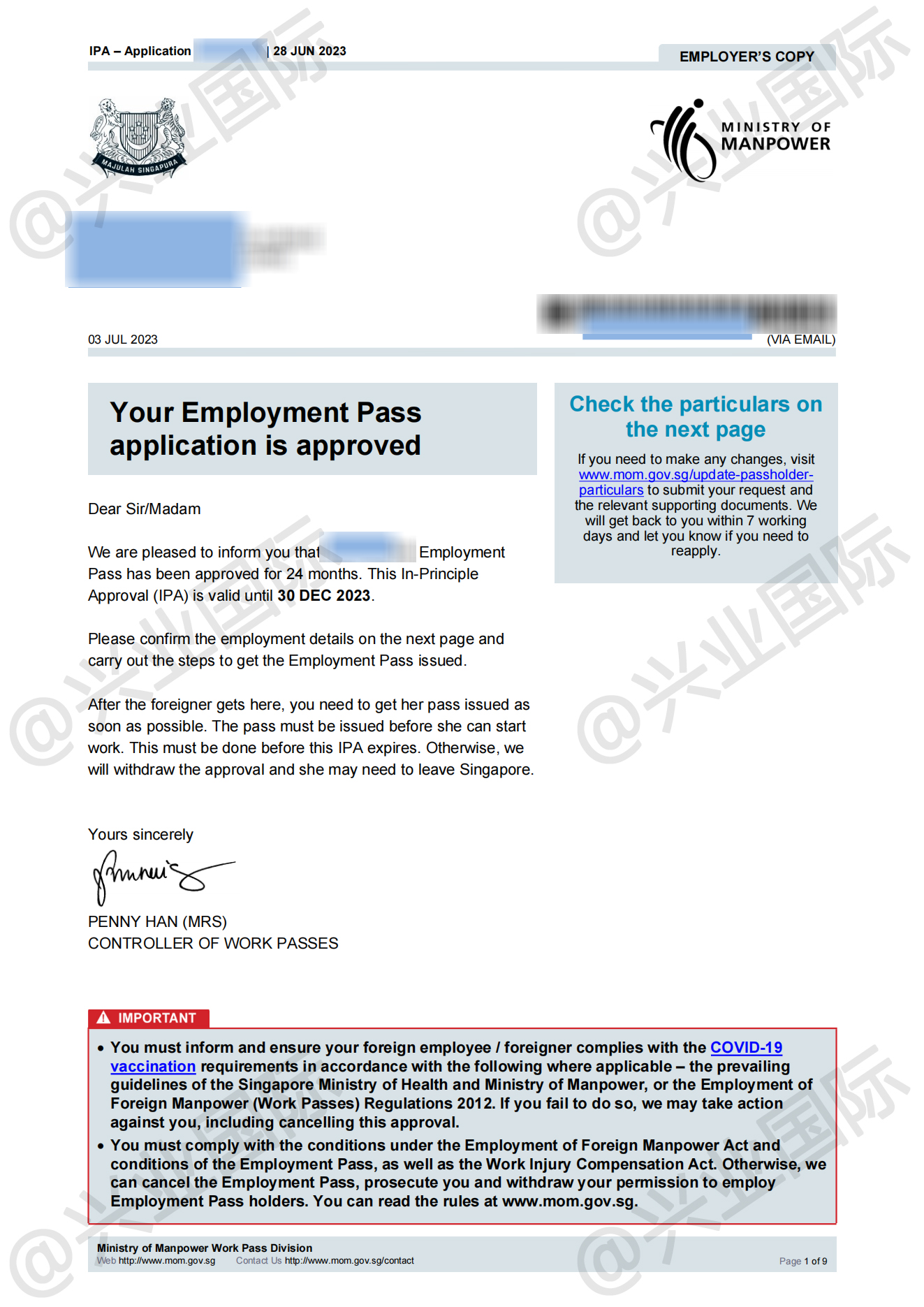

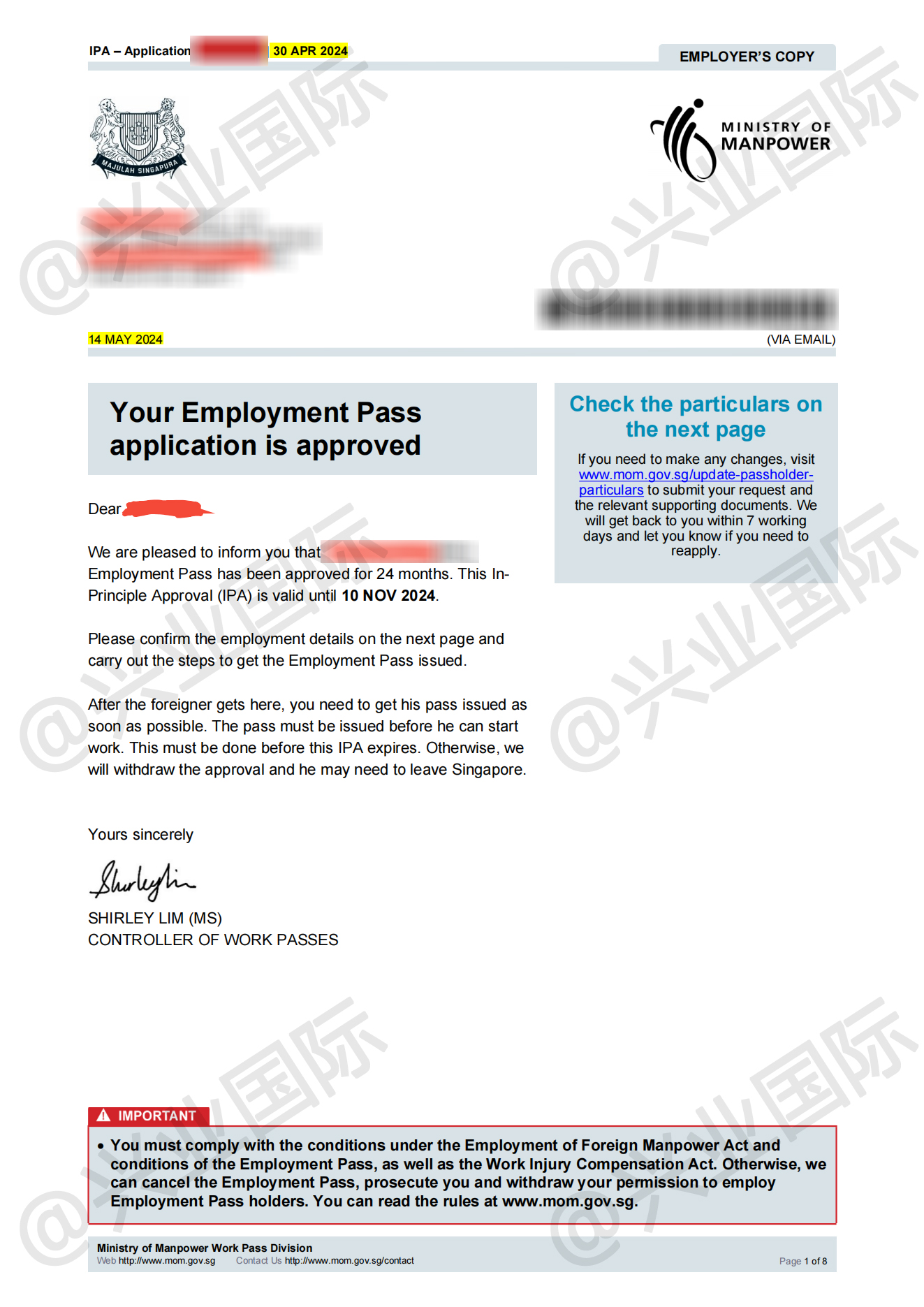

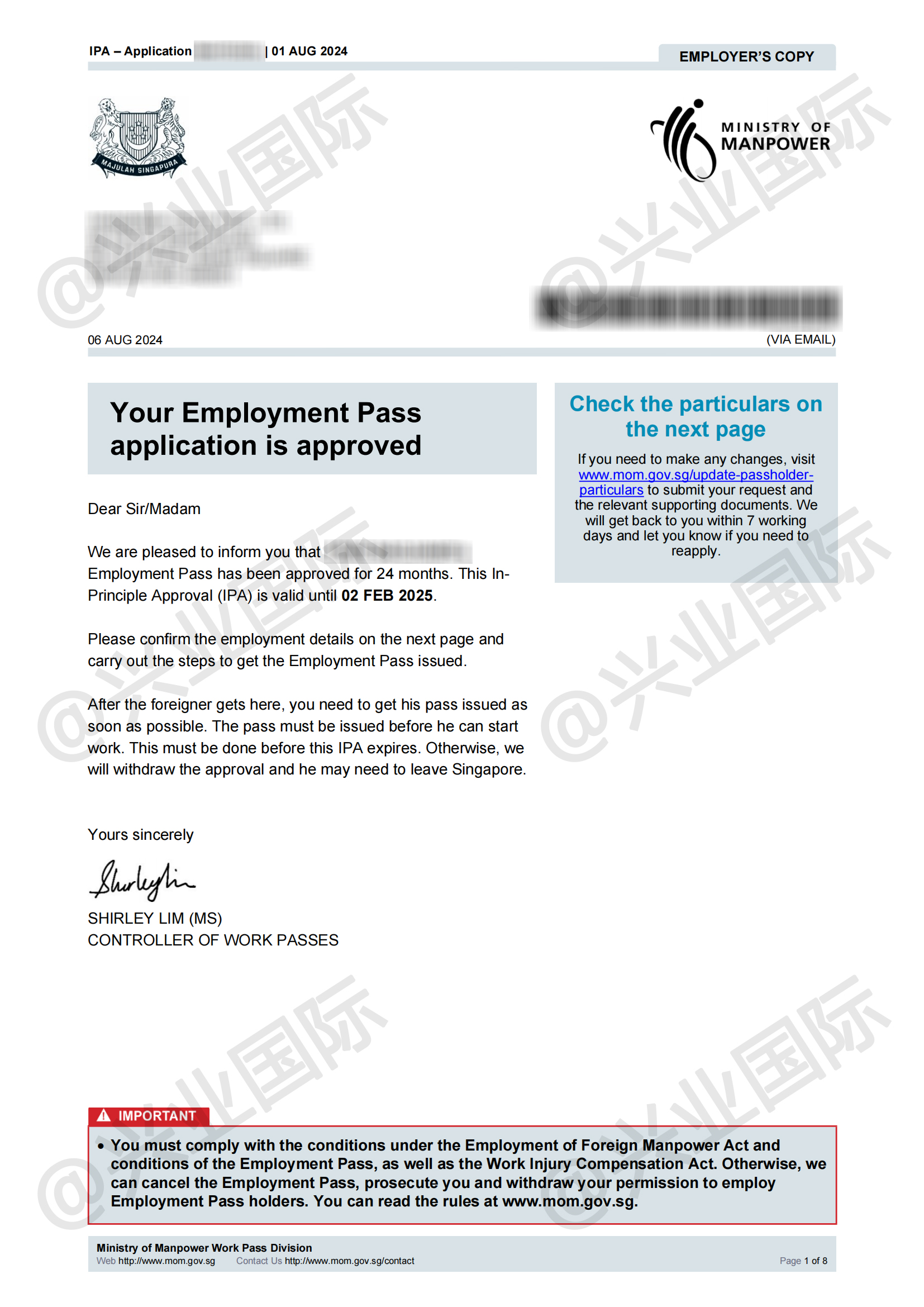

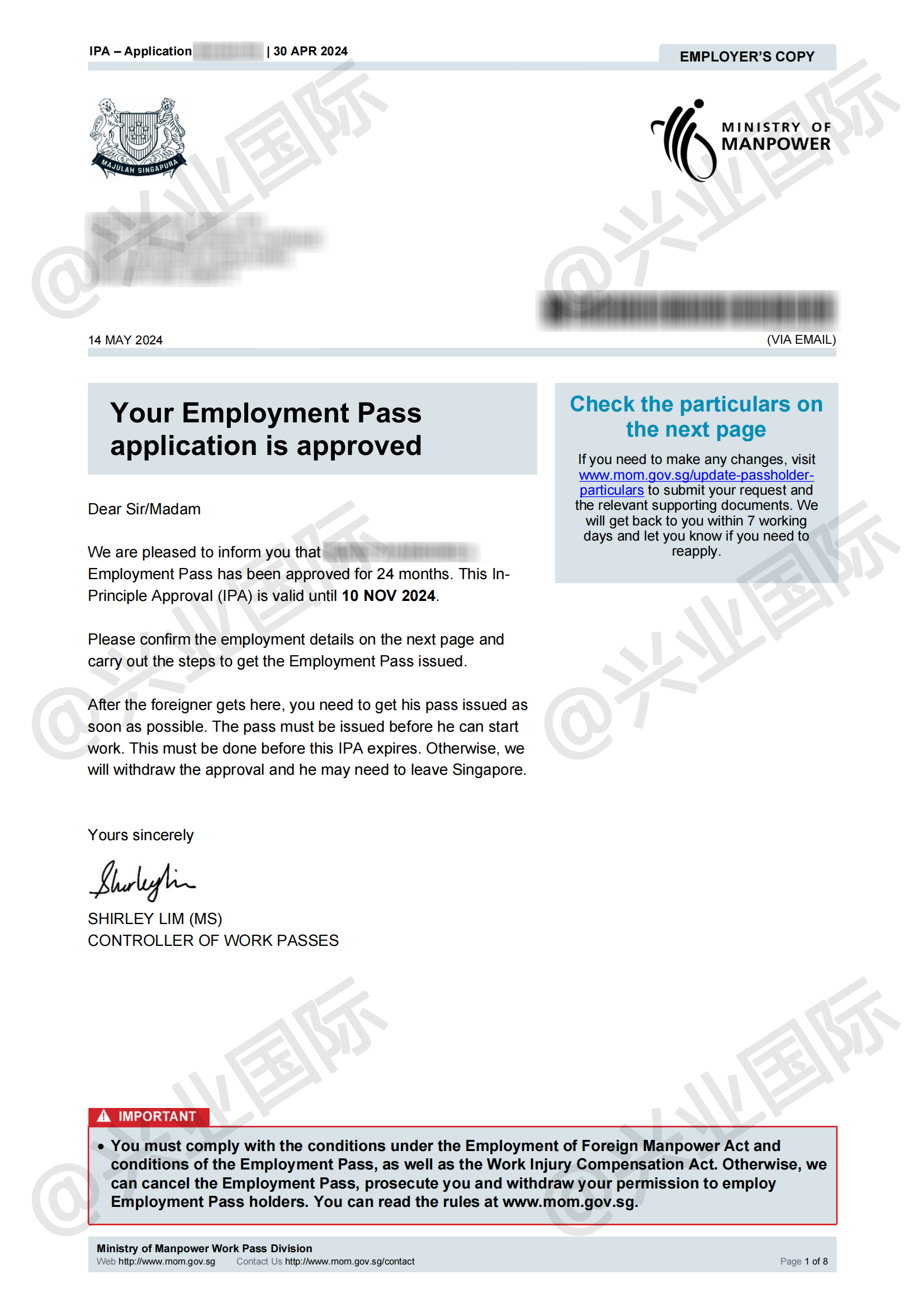

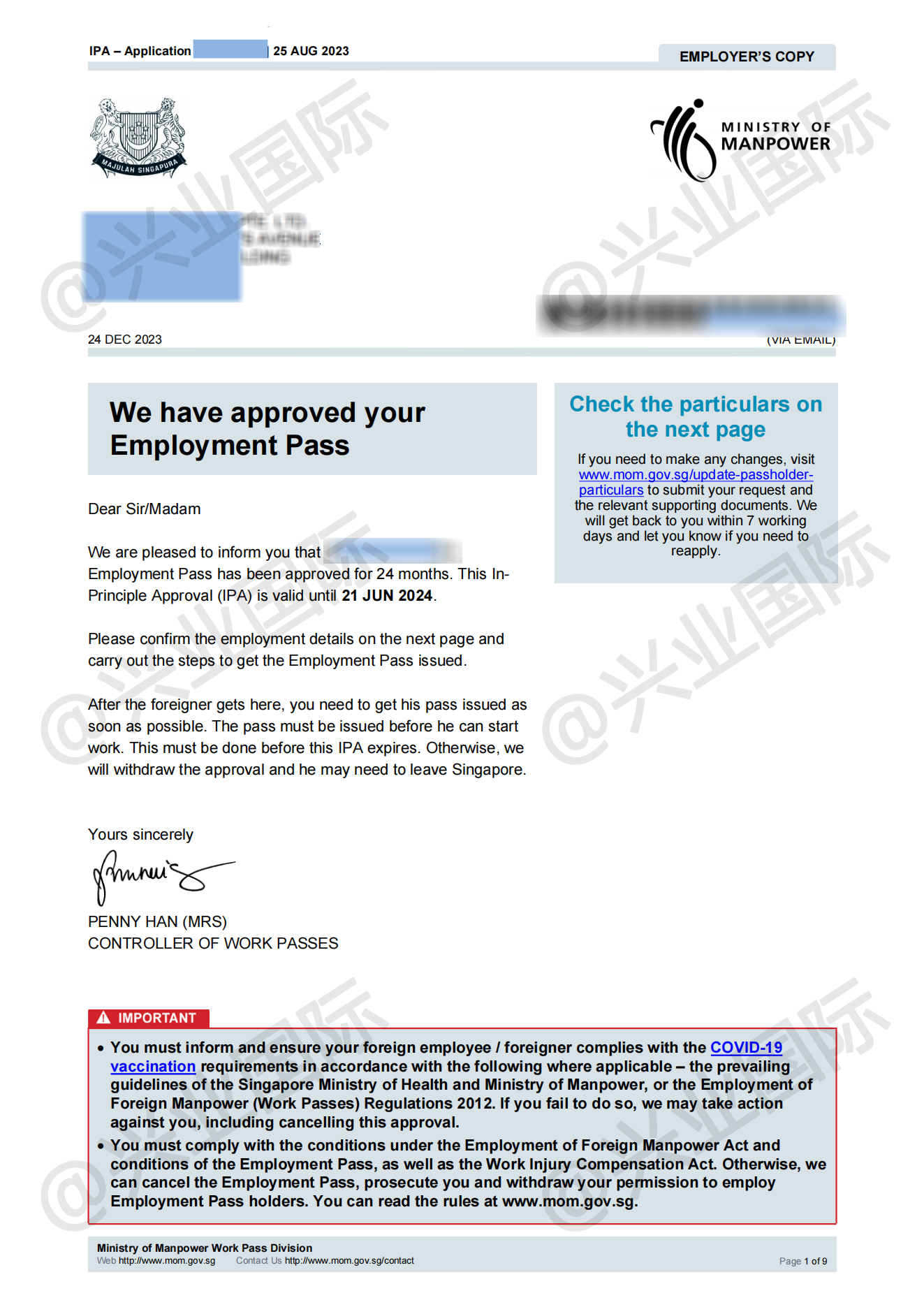

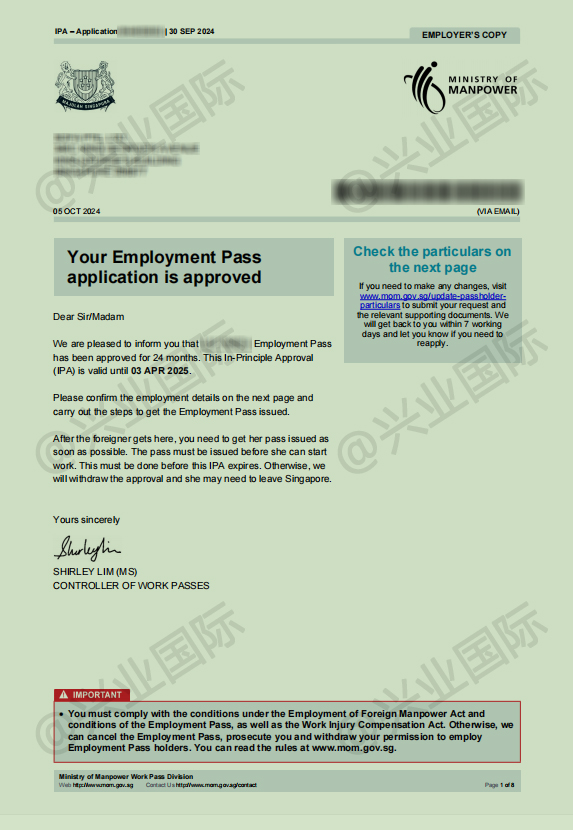

Self employed EP in Singapore

Singapore's EP approval speed is fast and the approval rate is high. After obtaining the EP, one can apply for DP for their family members Learn more> -

Singapore PIC Self Employed

PIC self-employed individuals who hold EP for six months are eligible to apply to become permanent residents of Singapore, with their family members as dependent applicants Learn more>

-

Singapore Family Office

The income obtained from investment can enjoy permanent tax exemption treatment Learn more> -

Hong Kong High end Talent Program

Highly free, no need for employment, can start or work independently Learn more> -

Hong Kong Outstanding Talents Scheme

One person applies for the benefit of the whole family, and children can enjoy more educational resources Learn more>

Honor comes from strength, trust comes from professionalism

For the past 15 years, we have been committed to providing reliable overseas investment consulting services to our clients, offering more professional solutions in overseas investment, tax planning, and identity planning, and providing high-value services higher than those in the same industry

We specialize in providing consulting services for overseas investment of enterprises

Provide feasible solutions for overseas company registration, immigration status planning, and offshore tax architecture construction for enterprises

-

15 年

Investment service experience

-

30000 +

Customer Case

-

200 家

Service TOP Enterprises

-

90 %

Customer renewal rate

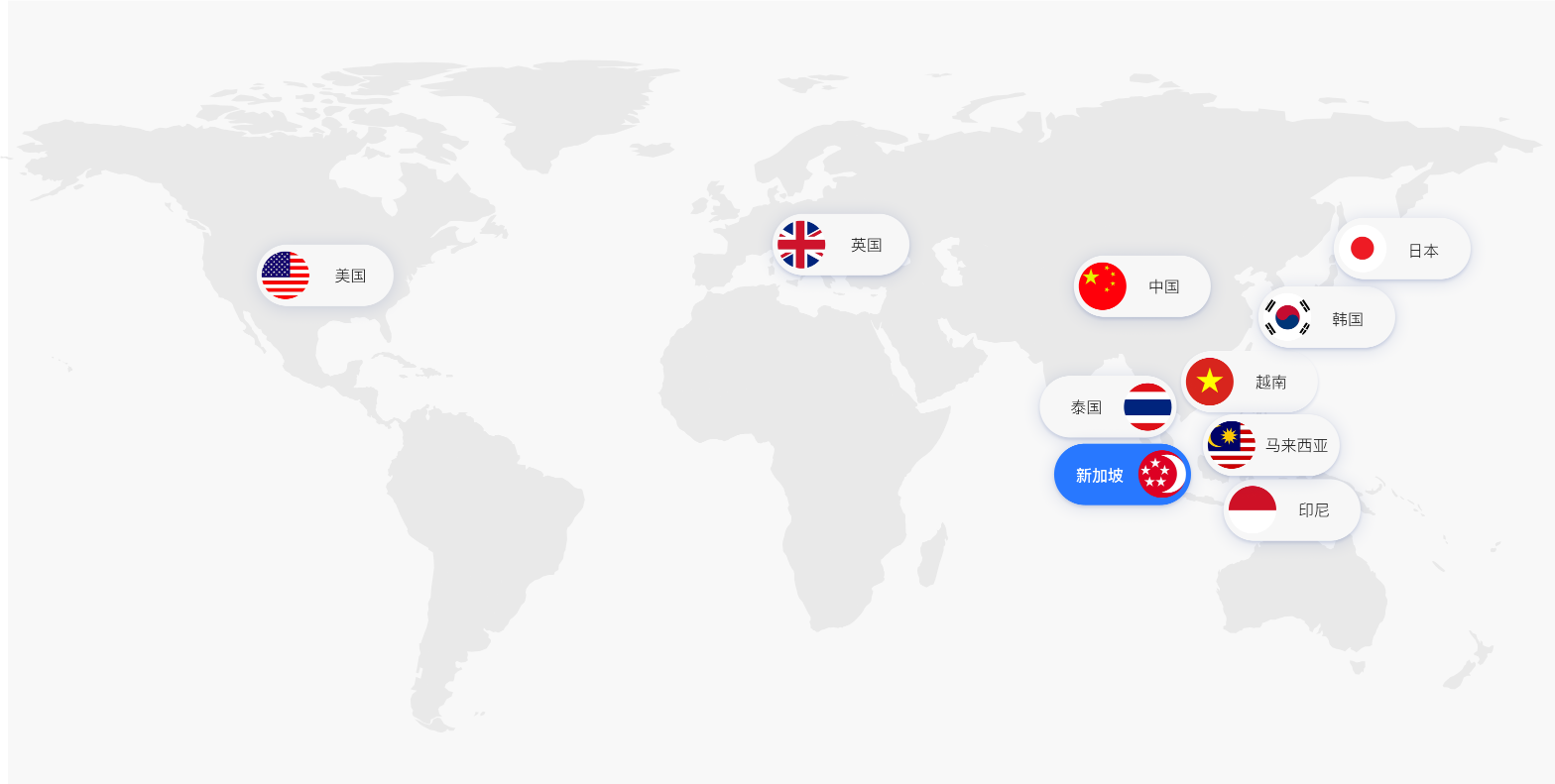

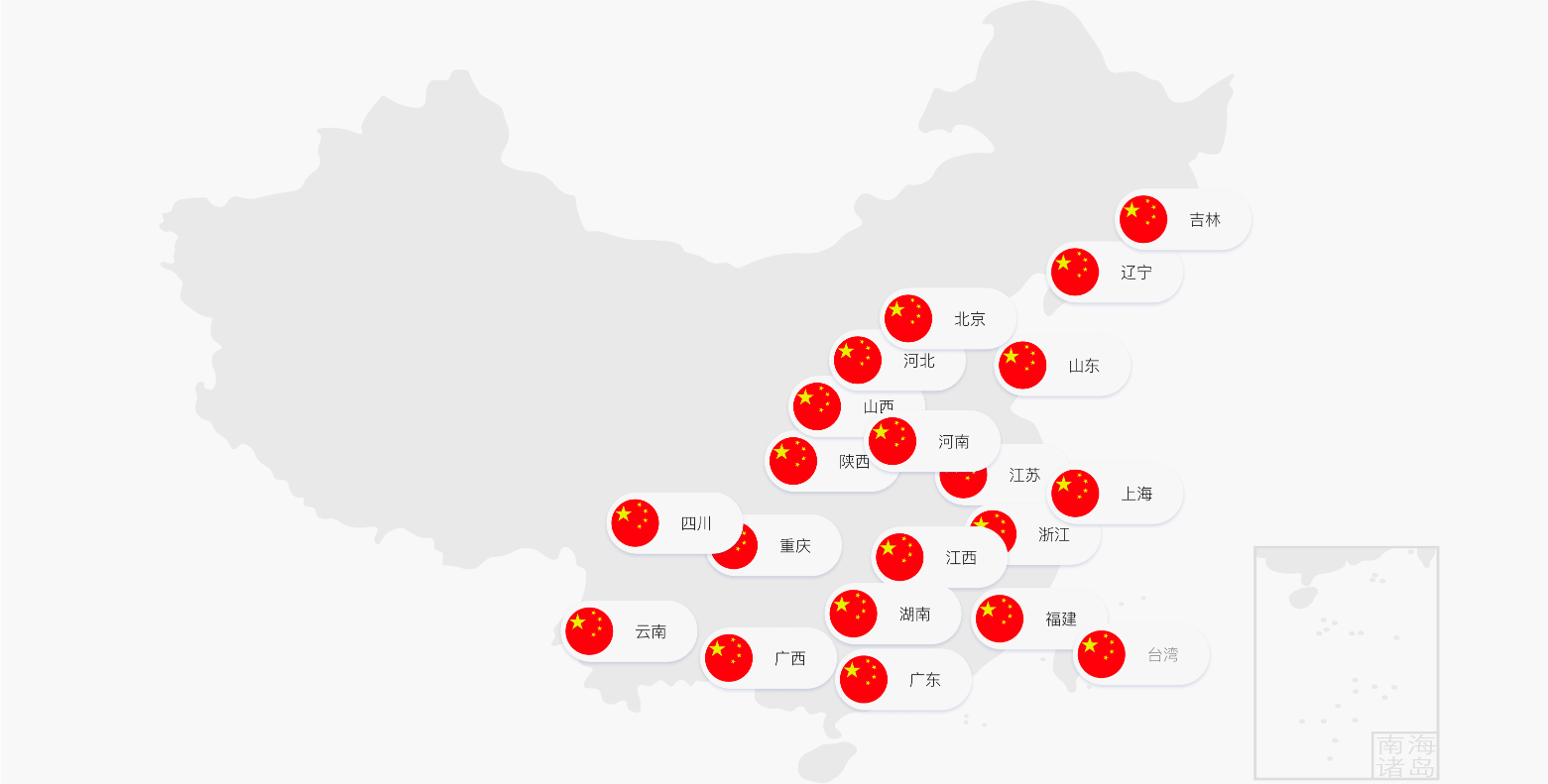

Global Services

Our clients cover 26 provinces and cities across the country, as well as multiple countries such as Singapore, Japan, South Korea, and Vietnam. We have provided overseas company registration, tax structure construction, and ODI overseas investment filing solutions for over 30000 clients

Recommended by contracted clients

30000+

Enterprise witnesses service quality

Overseas Q&A

在新加坡注册公司,为什么受很多老板喜欢?

常有人问我,为什么这两年呢,那么多人都选择去新加坡注册公司,新加坡到底有什么魅力?那首先咱们得说说新加坡这个国家,地方不大,700多平方公里,跟上海的1/8差不多,土地和人力成本呢都挺高,在这儿开工厂或者搞点附加产值的产业确实呢不太适合。那为什么新加坡被称为企业之都,什么样的企业呢,适合在这里设立公司,我来跟您分析分析:

新加坡注册公司5大优势

新加坡公司它的税很低,它没有增值税,没有营业税,根据公司的净利润呢,会有17%的利得税,但是呢,股东分红它没有个人所得税,公司的利润呢,可以合法的分红到股东的个人账户。

在新加坡注册公司为什么受很多老板喜欢?

新加坡的税制简单,税率低,所得税。税率呢,只有17%,一般的中小企业呢,都会有这个税务减免政策,而且大型企业还可以申请税收优惠政策。

Consultation on ODI investment filing issues

ConsultingConsultation on bank account opening issues

Consulting

在新加坡注册公司,为什么受很多老板喜欢?

常有人问我,为什么这两年呢,那么多人都选择去新加坡注册公司,新加坡到底有什么魅力?那首先咱们得说说新加坡这个国家,地方不大,700多平方公里,跟上海的1/8差不多,土地和人力成本呢都挺高,在这儿开工厂或者搞点附加产值的产业确实呢不太适合。那为什么新加坡被称为企业之都,什么样的企业呢,适合在这里设立公司,我来跟您分析分析:

新加坡注册公司5大优势

新加坡公司它的税很低,它没有增值税,没有营业税,根据公司的净利润呢,会有17%的利得税,但是呢,股东分红它没有个人所得税,公司的利润呢,可以合法的分红到股东的个人账户。

在新加坡注册公司为什么受很多老板喜欢?

新加坡的税制简单,税率低,所得税。税率呢,只有17%,一般的中小企业呢,都会有这个税务减免政策,而且大型企业还可以申请税收优惠政策。

Consulting on company registration issues

Consulting